We’re here to help you navigate the numbers and close deals that drive your business forward.

Financing for Acquisitions

-

We specialize in securing customized financing solutions for commercial property acquisitions, providing a range of options tailored to fit the unique needs of each client. Whether you're seeking a straightforward traditional loan or navigating the complexities of more advanced debt structures, we have the expertise to ensure your financing aligns with your strategic goals. Our deep understanding of the capital markets allows us to offer flexible and innovative solutions, giving you the confidence to move forward with acquisitions that drive long-term growth. From initial consultation to final closing, we guide you every step of the way, ensuring a smooth process and optimal outcomes for your real estate investments.

Equity Partnerships

-

Tap into our extensive network of equity investors and joint venture partners to raise the capital you need for larger acquisitions or development projects. We connect you with the right partners, aligning their investment goals with your vision to create opportunities for shared success. Whether you're expanding your portfolio or breaking ground on a new development, we provide access to capital solutions that are flexible and tailored to the scale of your projects. Our expertise in structuring equity partnerships ensures that you secure the resources necessary to bring your most ambitious real estate plans to life, with a focus on long-term value and strategic growth.

Refinancing Existing Assets

-

Optimize your capital structure by partnering with us to refinance your existing assets, allowing you to improve loan terms and enhance cash flow. Our team works closely with you to assess your current financing and identify opportunities for more favorable conditions that can reduce costs or free up equity for reinvestment. Whether you're looking to lower interest rates, extend loan maturity, or unlock capital, our refinancing strategies are designed to maximize the performance of your assets. With our expertise, you can streamline your financial position and ensure long-term stability for your commercial real estate portfolio.

Sourcing Construction Financing

-

We connect you with the right lenders to secure construction financing, ensuring you have the capital needed to bring your development projects to life. Whether you’re building from the ground up or expanding an existing asset, we leverage our strong relationships with top lenders to provide financing solutions that are tailored to your project’s scale and timeline. Our team works to secure competitive terms, so you can focus on executing your vision while having the financial support necessary to keep your development moving forward. With us by your side, your construction project is set up for success from start to finish.

Access to Institutional Investors

-

Gain access to institutional investors through our strong brokerage relationships, opening the door to capital for large-scale projects or portfolio investments. We connect you with leading institutional partners who are looking for opportunities to invest in substantial real estate ventures. Whether you're expanding your portfolio or launching a major development, our network provides the financial backing you need to move forward with confidence. With our guidance, you can tap into institutional capital that aligns with your vision and scale your projects to new heights.

Portfolio Refinancing or Sale

-

Whether you're refinancing or selling your portfolio, we help you optimize liquidity and ensure your assets are positioned for maximum value. Our team works closely with you to assess the best strategies for your portfolio, whether it's securing better financing terms or preparing for a sale. With our expertise, you can confidently move forward, knowing your assets are structured to achieve the highest possible returns while meeting your long-term financial goals.

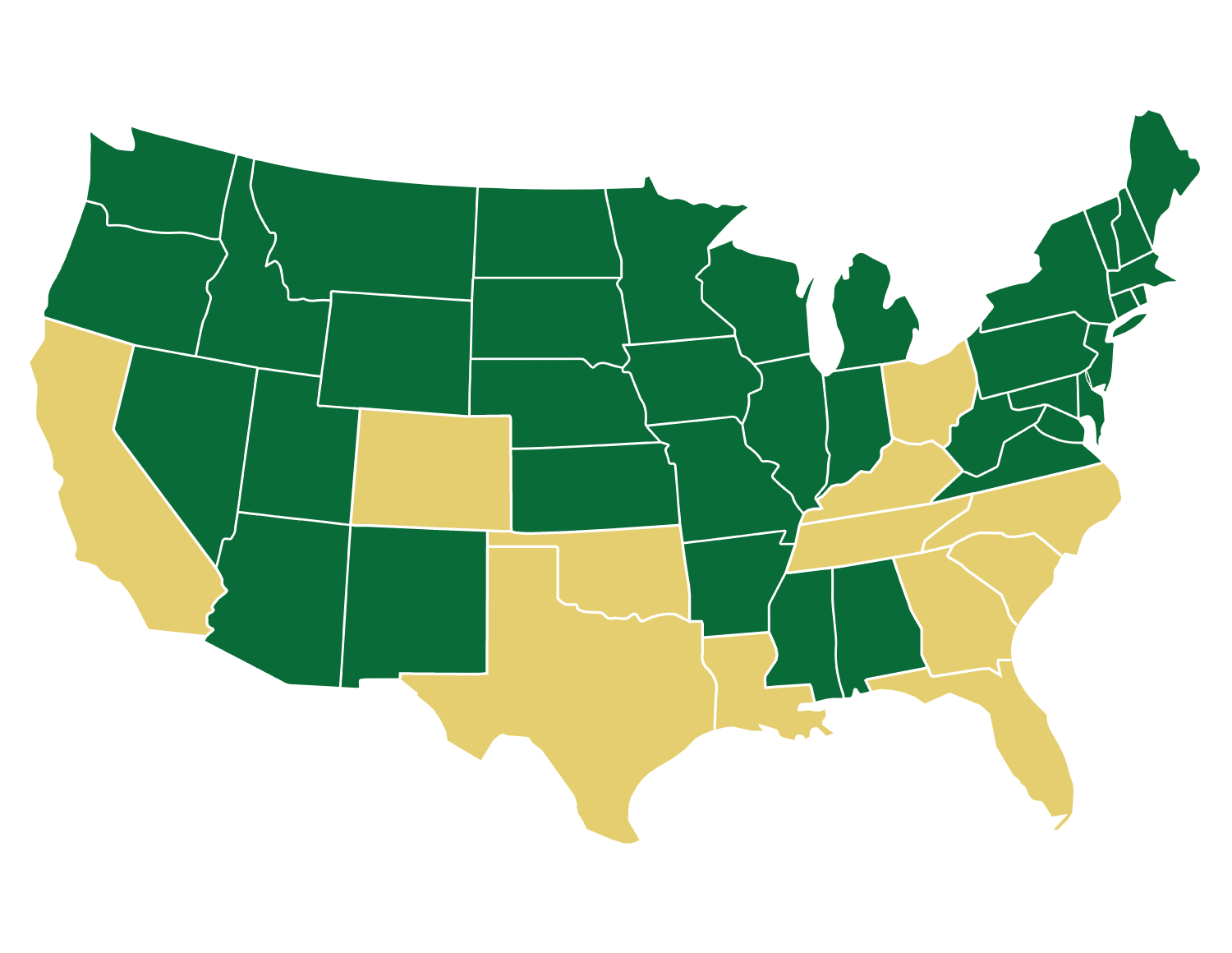

Our Track Record

-

California

Colorado

Florida

Georgia

Kentucky

Louisiana

North Carolina

Ohio

Oklahoma

South Carolina

Tennessee

Texas

-

Atlanta

Aurora

Austin

Bartlett

Boca Raton

Burlington

Charleston

Charlotte

College Station

Columbia

Columbus

Conroe

Dallas

Daytona Beach

Deer Park

Delaware

Fort Lauderdale

Fort Worth

Galveston

Houston

Jacksonville

Kennesaw

Lexington

Lithonia

Lubbock

McDonough

Mesquite

Montgomery

Morrow

Oklahoma City

Orlando

Pinehurst

Richmond

San Leandro

Savannah

Shreveport

South Houston

Meet Your Partners

We’re more than just capital markets advisors—we’re your trusted partners, committed to guiding you through every stage of the process. With a firm handshake and a no-nonsense approach, we’ll help you navigate the complexities of securing financing, structuring deals, and ensuring your investments deliver. Whether you're raising capital, refinancing, or optimizing your portfolio, we're here to make sure you succeed.

-

Jackson Randolph is the Director of Capital Markets & Investments at Alpine Partners. Before joining Alpine, he held roles as a multifamily acquisitions deal lead for boutique commercial real estate investment firms and was a member of Newmark’s Debt, Equity, and Structured Finance Team within its Capital Markets Platform. To date, he has successfully arranged financing for, acquired, or developed $3.7 billion in transaction volume. A Houston native, Jackson holds a Bachelor of Business Administration in finance and a Master of Land Economics and Real Estate from Texas A&M University’s Mays Business School.

-

Derick Perkins is a Partner at Alpine Partners. Before co-founding Alpine, he served as the Director of Brokerage for a boutique brokerage firm in Houston. He lead a team that transacted more than $150M worth Commercial Real Estate deals in 2021. Perkins also has extensive experience in the Energy sector as a Partner of a Regional Oilfield Services & Manufacturing Company. Prior to his time in business, Perkins was a college football coach at Texas Tech University, where he worked on the Offensive Staff. Since starting Alpine, Derick has transacted more than 1,000,000 square feet of Industrial & Adaptive Re-use Sales & Leasing Assignments across Texas. He and his wife Erin, both grew up in the heart of the Permian Basin, Midland, TX. He and Erin, who is an OB-GYN Physician Texas Children’s Hospital, reside in the Houston Heights.

-

Kyle Fischer is the Managing Partner at Alpine Partners. Before Co-founding Alpine, he was named top 3 in the city of Houston for Broker of the Year by completing over $350M worth of transactions in his first five years of being a Commercial Real Estate Broker. Fischer is passionate about helping and guiding people to become the best they can be, which he proved in his previous career as a highly successful High School football coach. Fischer helped his players garner over $1.5M worth of athletic scholarships in his coaching career. Fischer has brought that same care for others into Real Estate. Fischer ensures that all Alpine's clients are treated with great respect and guided through the transaction process to get the best deal possible. Kyle resides in the Uptown area and is a boxing and football fan. Some of the charities close to Kyle's heart are The Angel House - which supports and shelters abused Women and Children, and The love and Rescue animal fostering group.